The mismanagement of customers loyalty

Summary and solutions of the most usual mistakes concerning the customers’ loyalty and their management

This article aims to find a solution to avoid the waste of money represented by a mismanagement of loyalty, and tries to improve the use of loyal customers. I have tried to find solutions to define, as accurately as possible, who is loyal, and how to deal with such information.

The misunderstanding of loyalty

For most companies, a loyal customer is the best customer they could have.

A loyal customer is often considered as a profitable customer who often and consistently purchases the same brand and who spreads his knowledge and opinion about the company.

A loyal consumer is supposed to cost less (compared to a normal one), to be able to pay more, and to spread the brand name by Word of Mouth.

Nevertheless, a loyal customer is not always as profitable for a company as we would think. First of all, because some of those hypothesis can be refuted, then because the technique that companies use to define who is loyal is often not accurate.

Finally, a loyal customer is often considered as a consumer who has an exclusive loyalty (means that the consumer buys ONLY this brand, no other for this kind of product). It is mainly wrong: most consumers have a shared loyalty. It is really rare to find a consumer who has an exclusive loyalty. However, a shared loyalty doesn’t mean disloyalty: a consumer can be loyal to several brands and really loyal to yours in the same time.

First, why some hypothesis can be refuted:

We consider that a loyal consumer cost less. However, a loyal consumer expects from us some reward, due to the fact that he is really faithful. Moreover, because many companies consider some “normal consumers” as “loyal”, they waste money by treating them in this way. Therefore, loyal customer can be more expensive than a normal one if we do not define clearly who is loyal and how to deal with.

We consider that a loyal consumer would agree to pay more. In theory, it is true: a loyal customer “loves” a brand, and would agree to pay higher price to continue purchasing his favorite brand. However, as loyal and faithful, he also consider that he should get some advantage from his position, and expect some “special discount” compared to normal consumers. Therefore, a loyal customer won’t pay more than another.

We finally consider that a loyal customer would often do Word of Mouth. Once again, it is not totally true: few people will talk about what they like. If a consumer is really disappointed by your service, he will immediately share his opinion. But if he likes it, the chance he would spread this opinion if really low. Loyal customers are the best customers to use Word of Mouth (because they have much information), but they are not using it more often than any other.

Then, why the technique of most companies is not accurate:

Usually, to define which customer can be considered as a “loyal” customer, we would use the RFM system (Recency, Frequency and Monetary value) or any similar system. RFM will consider how often a customer purchases and how much to define if this customer can be considered as a loyal customer or not.

With this information, the company will be able to create some programs to deal with those loyal customers. Loyalty programs and Retaining Programs would be used on the different levels of loyal customers.

How to define more accurately who is a real loyal consumer

To know if a customer buys often and how much is important to define the value of a customer. Nevertheless, it is not enough to consider if somebody is loyal or not. A loyal customer is somebody who continues to purchase.

Many companies make the mistake in defining what a loyal customer is. They consider a loyal customer is somebody who purchased a lot one time, even if he didn’t purchase anymore later on. They would also consider as a loyal customer somebody who purchased several times, without any consideration about knowing if they will continue to purchase in the future.

Here is a big mistake: if we consider as loyal those customers who won’t buy anymore, we waste money by investing some programs on them. The best solution would be to define, as early as possible, which customer is really loyal and profitable, and which one is not.

In order to know, we can use another method to supplement the RMF approach.

The tn method

First of all, let me introduce a new method: the tn method would be used to predict if a customer will still buy in the future or not. By calculating tn (considering a period, n would be the number of purchases made in this period, and t the fraction of period represented by the difference between the first purchase and the last purchase), we can estimate in percentage the probability that the customer would make a new purchase in the future.

My suggestion: a better method

Then, by using this method and combining this with RFM, we would be able to define more accurately which customer would be a loyal customer, and which customer we should treat with a specific program.

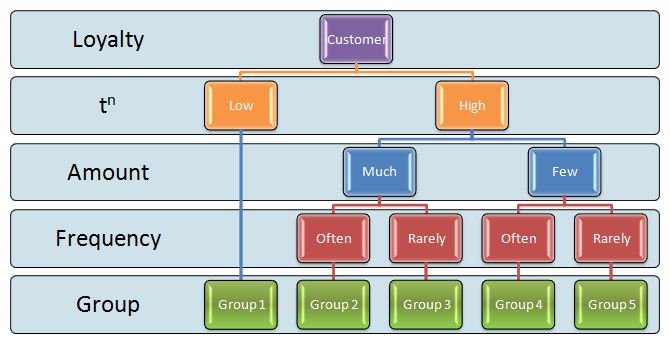

First of all, we consider a customer. Then we calculate his tn. If his tn is low, it simply means that the probability that he will purchase in the future is low also. Indeed, even if he bought a lot in the past and was really profitable, we should not consider him as a loyal customer, and not invest any money on him.

Then, if his tn is high, we should consider the total amount of purchase he has done during the considered period. This criteria would not help to define the fidelity of the customer, but to know which program would be the most suitable for him.

Then we define the frequency of the customer’s purchase. If he often buys, we won’t consider him the same as if he really seldom buys.

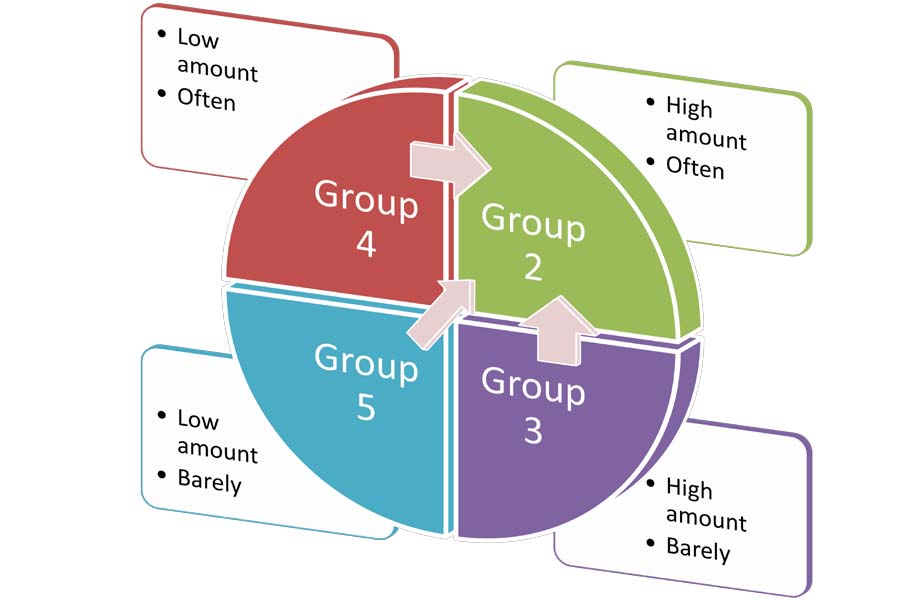

Finally, this customer study will enable us to define which category of customers he is in. The members of group 1 should not be considered as loyal customers, and no retaining or fidelity program should be applied on. The time we can define a customer as a group one’s customer is the right time to drop this customer. The group 5 should not be considered for any program: customers belonging to this group are not really profitable. However, they are faithful, and we could consider using them for word of mouth. But we will talk about this point later on. For the other groups (2,3 and 4), we will consider each of them by using the following method:

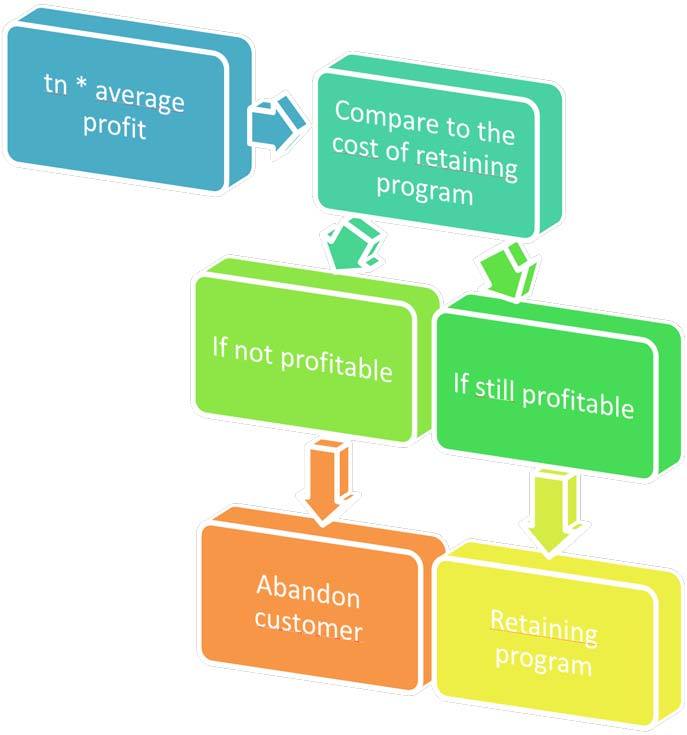

To multiply tn by the average profit of the period would enable us to have an approximate idea of the future profit of this customer. Then, by comparing it with the cost of a retaining program, we can consider the opportunity of using a program on him, or get rid of him.

The previous chart explains how to deal with the different groups.

Actually, customers of the group 2 are the most interesting: they buy often, and high amounts of money. It means that they like the shop, they like to come often, and they do not consider spending a lot of money in our company as a waste. Moreover, to be part of this group, it means that their tn is high, so they will probably continue purchasing in our company later on. Each of those group’s member, who has profitability higher than retaining cost, should have a retaining program applied on. To keep this kind of customer is primary for a company. Our goal would be to keep the customers of group 2, and to move customers from group 3,4 and 5 to this group.

For group 3, it would be better to move them to group 2 by encouraging them to consume more often. For example, we could apply on them a personalized program, based on their habits, which would enable them to know all the new products we have which could correspond to what they like. Nevertheless, we need to consider two main limits: first of all, this program should be applied only if the profitability of the customer is higher than the cost of the program, then this program should be limited: to send information sometimes is considered by the consumer as an interesting news, but too much information would be considered as a spam, and would make him nonplussed by our information.

Concerning to group 4, we should encourage them to buy more. They already come often, but never purchase a large amount. We could apply a program to encourage them to purchase more every time (a loyalty program; for example, to award them every time they reach a certain amount of purchase), in order to move them from group 4 to group 2. As usual, this program should only be applied on consumers who are profitable enough.

Group 5 is the most difficult to deal with. They seldom buy, not much, but they will continue to come later on. They are, most of time, not profitable enough for any retaining program or loyalty program. However, it would be better to be able to move them from group 5 to any other group. For the customers of this group who are profitable enough, we should use a program to move them. For others, we can just considerate another of their value: they know the company and they like it (because they still come, even not often, and will continue to come in the future). Therefore, they could be a good vector of word of mouth. We will talk about this possibility later.

How to deal with a customer

Another important thing to define how to treat a customer is to define which kind of customer he is, as early as possible.

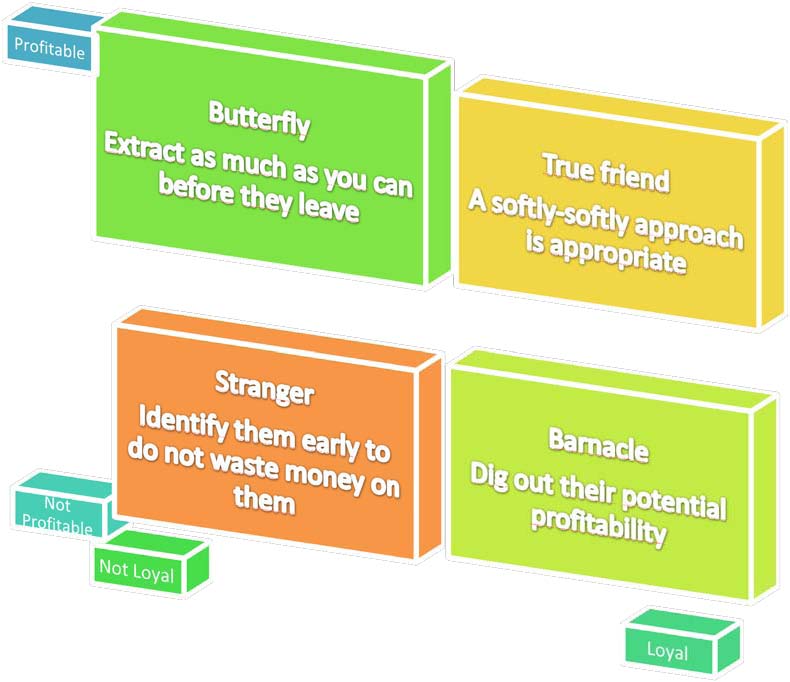

The true friend would be a customer from group 2, 3 or 4: he is loyal, profitable, and we need to deal with him. The barnacle would more often come from group 5: really loyal, but not really profitable. His loyalty could be used in word of mouth, but investing on him could be a waste of money. Stranger and Butterfly both come from group 1: they came one time, but probably won’t come anymore. For both of them, we should not invest any money and absolutely not use them for Word of Mouth: they do not know the company, their information would be wrong or not accurate enough, and their opinion would not be controllable. Nevertheless, the Butterflies are really profitable for a short period of time (often during the discount annual period): we should try to extract from them as much as we can.

Example:

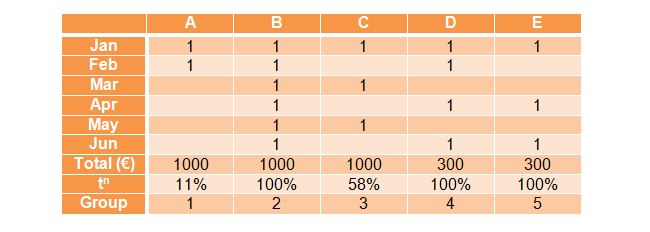

Let’s consider three customers, A B C D E. Each of those consumers bought for the first time in January year 1. The following chart will show their purchases during a six months period:

To simplify, the calculation of tn works as follow:

- Choose the calculation period and calculate the number of months included. For example, I calculate on the period "January - June" which contains 6 months.

- Define the last purchase date for the customer you are analyzing. For example, Mister Anyone purchased for the last time in February. February is the second month of the chosen period, therefore the last purchase time is "2".

- Define your "t" using the following calculation formula: t = last purchase time / number of months of the chosen period. In my example, t = 2/6

- Define your "n" using the following method: n represents the number of purchases during the chosen period. Note that we are here talking about the number of purchases, not the amount of purchases nor the number of items purchased. In our example, Mister Anyone purchased twice in January and once in February. Consequently, n = 3

- Define your tn as follow: (2/6)3 = t * t * t = 0.037 = 3.7%

Let's calculate the tn of A and C together to clarify the previous table:

- A had his last purchase in February, on a 6 months period, therefore t=2/6

- A had two purchases during this period, hence n = 2

- tn = 0.11 = 11%

Similarly,

- C had his last purchase in May in a 6 months period, therefore t=5/6

- C had 3 purchases during this period, hence n = 3

- tn = 0,58 = 58%

“A” would be a “trap customer” for a company who would only use RFM, even more if they use this system on a short period only. For this kind of company, “A” spends a lot of money and comes often (2 times in two months): he is a loyal customer. Nevertheless, considering the tn system, “A” is a butterfly: he comes just for a short period, spends a lot, and probably won’t come anymore: he is absolutely not a loyal customer, and to spend money on him would be a real waste of money. He is a group one’s member, and should be considered as it.

“B” is definitively a group two’s customer: he is loyal, has a high tn (probably will come again), spends a lot of money, and purchases often. This customer is probably the most valuable customer, compared to the other four.

“C” would be a group three’s customer: he spends a lot of money, but does not come often. It is pretty sure that he will continue purchasing in our company, regarding to the tn results.

“D” would be a group four’s customer: he spends little money, but he comes often. His tn shows that he will probably purchase again on the next period.

Finally, “E” would be a member of group 5: he is not somebody who spends a lot of money, and even not somebody who often purchases. Nevertheless, this member would continue buying on the next period, as shows tn.

This example shows how easy it is to define which group a consumer belongs to thanks to the tn system. After an easy calculation, depending to the price per consumer for each program of the company (retaining, loyalty, referring), we could even say for each customer which program it would be smart to apply on him.

The importance of behavior

Now, we can define more accurately if a customer can be considered as a loyal customer or not.

Nevertheless, this method is still not 100% sure: the only way to know if a consumer is really loyal would be a behavior survey on each consumer. A real loyal consumer is a consumer who often comes, who purchases a lot, but also who likes the brand, who has a good behavior with the brand. If he buys by obligation, necessity, convenience, but dislikes the brand, he is NOT a loyal consumer. This kind a customer is also a fake loyal consumer, because they waste the money we invest on them. Therefore, we should check each consumer behavior.

Of course, this kind of approcach is impossible: to question each consumer about his behavior would be extremely expensive, not totally accurate (some people won’t say the truth) and not complete (many customers won’t want to answer personal questions).

How to deal with a consumer to make him move to another group

To understand who is the consumer:

A consumer has two main parts: a customer part, and a personal part. The customer part is the same for everyone. To content this part, ones just need to follow some basic rules:

To have a good product, a good after-sale service, a smiling, helpful and polite staff, a low delay of answering questions and queries, a good quality of advice, etc…

But to content the personal part, it is more complicated. We need to understand who our customer is, his priorities, his willing, and his behavior. This part will completely change from one to another.

If we are able to collect data about a customer, to deal with those data correctly, and to give a personal help to him, this customer will feel involved in the company, and will move from group one to any of the other groups. And this method is the best to improve the quality of the consumer, until he becomes a member of group 2, and to keep him in this group.

To understand the degree of loyalty of a customer:

Once we have defined a customer as being a loyal customer, we can easily evaluate his degree of loyalty. In order to get this information, three questions are enough:

- If you could change the past, would you buy the same brand again?

- In the future, will you buy this brand again?

- Would you advise your friends to buy this brand?

Those questions would enable us to define if a customer is a good or a bad loyal customer.

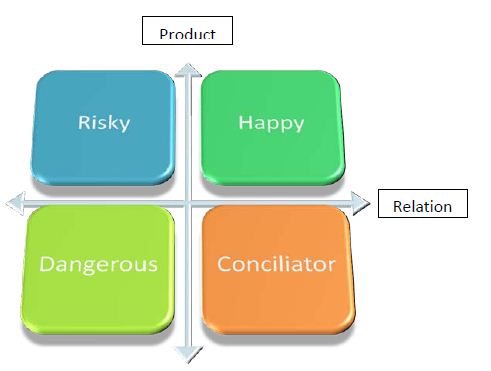

Let’s divide loyal customers in 4 parts, to define if they can have a use for Words of Mouth:

A customer who would enjoy his last purchase, would want to buy again, and would be able to advise a friend positively, would be a “happy customer”, with a good relation indicator and good product feeling. This kind of consumer would be really useful for Words of Mouth.

A consumer who would like the company, but not the products, would be a “conciliator customer”: he dislikes the product, but his affection for the company makes him have a good global opinion. He would not be a good vector for Words of Mouth: people consider the product as more important.

A consumer who regrets his last purchase becomes immediately a “dangerous customer”: he will be really easy to complain and spread his bad experience. Even if you could not control him, try to never encourage him making Words of Mouth.

A consumer who would like the product, but not the company (impolite employees, long response time, bad after-sale service, etc…) is a “risky customer”: he could spread a good opinion as much as a bad one. To consider this kind of customer as a vector of Word of Mouth could b really risky.

The right way to develop Words of Mouth

First of all, the company needs to select really carefully who are the customers to trust and to encourage for the Word of Mouth. Mismanagement or a misunderstanding of Loyalty would change a good Word of Mouth in a real disaster.

Customers of group 2, 3, 4 and five could be potential vectors for Word of Mouth. Group 1 should be immediately set aside: even if some customers of this group could have a good message to spread, their knowledge about the company is too low for a good impact.

The remaining customers should be divided in “Happy”, “Risky”, “Dangerous” and “Conciliator” customers. Dangerous customers should obviously be separated from others. Concerning to “Risky” and “Conciliator”, it depends on the company willing.

Then, after having chosen the group of customers on which will the Word of Mouth program be applied, it will be time to choose the program itself: which message to transmit, which reward, which goal, etc…

Conclusion

To define exactly what is a loyal customer is primary in CRM.

To consider a “normal” customer as a “loyal” customer because of a wrong calculation would make the difference between a success and a fail. Retaining and Loyalty programs have a cost: this money should be invested ONLY on the right consumers.

Moreover, a company should be able to drop a customer if this one is not profitable. The belief that all the customers are equal and should be treated equally is wrong. To define the different categories of customers and to treat them accordingly is the KEY of a good management of Loyalty.

Finally, to understand that a loyal customer is not always a good vector for Word of Mouth is a mistake: loyal consumers should be divided again to select the potential vectors of Word of Mouth.

This article refers to the article of Reinartz and Kumar, “The Mismanagement of Customer Loyalty”.

If you would like to go even further, I recommend you to read my article "The NPS, a very useful tool to analyze your customer's loyalty".

Last update: 2024-04-15 Tags: CRM tn method customer relationship customer loyalty customer management customer service recognize valuable customer words of mouth customer strategy

Français

Français English

English